Building markets for small-scale solar to achieve affordable and clean energy for all

As of 2016, 1.1 billion people in the world remained without access to power. This represents a significant gap to fill to achieve the goal of universal access to affordable, reliable and clean energy by 2030 under the UN Sustainable Development Goal 7: Affordable and Clean Energy.

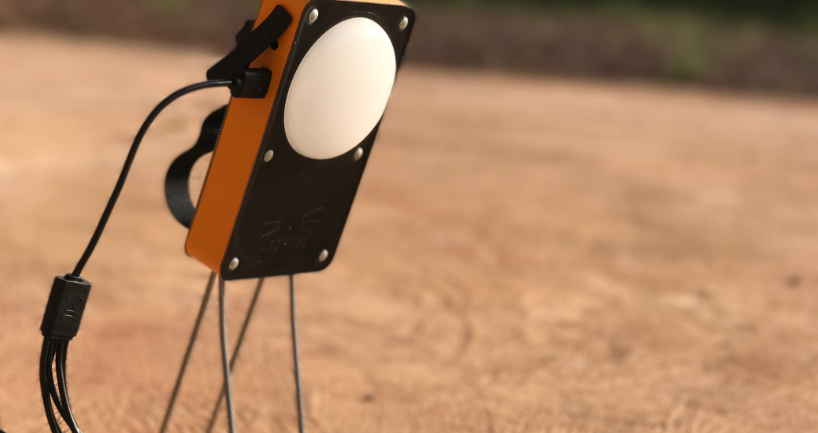

Renewable energy-based decentralized power solutions are expected to make a substantial contribution towards bridging this gap and connecting people to reliable and low cost sources of power, particularly in rural areas where a decreasing but still significant proportion of the developing world’s population still resides. Decentralized, small-scale solar solutions typically provide power for rural communities under two models. The first is off-grid solar home systems (SHS). These solutions include standalone technology for a single household or business – such as pico-solar systems – that power up to a handful of devices (lightbulbs, phone chargers, televisions), or dedicated rooftop solar systems capable of meeting all of a household’s modest electricity needs. Second, green mini-grids (GMG) are composed of a small generation unit and a local distribution network. Green mini-grids, which operate independently from the main grid, can connect several to a few thousand local households or businesses.

Wind, hydro-electric and biomass solutions currently represent the majority of the market in the development and delivery of sustainable power. Small-scale solar technology such as SHS and GMGs has historically struggled to provide a truly sustainable model for investment due to both the size and scope of these solutions, but this has already begun to change due to declining production costs and significant technological innovation. Over the last ten years, the overall cost of solar installations has steadily decreased while their performance has improved dramatically. As a result, small-scale power solutions such as SHS or GMGs have recently gained popularity as a way to provide cost effective and reliable access to power, particularly in locations where expansion of the transmission network is not financially viable such as communities distant from the main grid. The International Energy Agency for instance estimates that between now and 2030, decentralised solutions will provide two thirds of the new connections in rural areas, with off-grid systems projected to total over 55 terawatt hours (TWh), and mini grids to total over 72 TWh, which is more than what will be supplied through the main grid.[1] In Sub-Saharan Africa alone it estimated that about 80 million people will gain access to power through off grid systems and 140 million through min grids to 2040, which should translate into about 100,000 to 200,000 new mini grids[2].

While the future for such solutions does indeed look bright, investments in these innovative solutions are still limited and sitting far behind the level needed to ensure universal access to electricity by 2030. SE4ALL established that in 2013-2014, financial commitments for decentralized energy solutions represented only one per cent of the total amount committed in the countries tracked by the programme, a situation that SE4ALL considers “alarming”[3].

This being the case, how can development assistance and climate financing be used to unlock this potential and scale up in investments in decentralized power solutions such as solar home systems and green mini grids?

Challenges

In many developing countries, and particularly those with large rural, low-density populations and relatively limited foreign investment, decentralized, small-scale solar power solutions still lack the broader market acceptance that could see these sold and deployed in a truly sustainable manner. Market acceptance is actually extraordinarily difficult to achieve for new technologies breaking into incumbent market segments: it is not only the technology which must be flawless and work again and again without fail, but the underlying business model must be proven through demonstration and commercial operations, many times over. Customers or beneficiaries must be convinced with the value proposition of these systems from both a technical and financial standpoint. Investors must be convinced that these investments can provide an acceptable risk adjusted return in the form of predictable cash flows. With market acceptance comes access to low-cost capital, which is necessary to scale the business and compete on a level playing field with the existing competition that offer inferior, but well-established technologies.

In this light, five critical issues must be addressed to facilitate the scale-up of markets for decentralized solar power solutions and thereby greatly expand access to clean energy for all.

First, from the investor perspective, SHS and GMGs need to generate revenues in excess of their up-front investment and operational costs. In other words, projects must be financially sustainable: the products or the power needs to be sold, profitably, over the life of the project, and provide a return on investment. In areas where population is predominantly poor with a low ability to pay and little to no credit history, this can be a significant challenge.

Second, project developers and entrepreneurs in this market are often fairly new and small-scale. They have limited funds available. Because of the financial profile of customers and relatively long pay-back period, financiers tend perceive off grid and mini grid solutions as high risk and low return. Consequently, the availability of equity funding is limited and debt finance is essentially out of reach for developers and entrepreneurs in the decentralized power solutions space. The issue of lack of access to finance significantly inhibits the development of the market.

Third, developers and entrepreneurs in this space also face a currency risk, as revenues are collected in the local currency when costs, for instance in the form of equipment purchase, are in a foreign currency. This creates an additional risk that further erodes the attractiveness of decentralized power solutions as an investment.

Fourth, challenges also exist on the policy and regulatory side. In terms of economic regulations, electricity tariffs are one of the key drivers of the financial viability of green mini-grids. To ensure viability, the applicable tariff must indeed at least cover the costs of development and operations of the project. In many countries, however, in the absence of a differentiated tariff for renewable energy and decentralized power generation, the tariff applicable to GMGs defaults to the general tariff structure, which is often below what is needed for GMGs to operate profitably. Also, some countries impose restrictive tariff duties on the importation of solar equipment, which contributes to artificially driving up the cost of solar installations and stifling the growth of the market. Moreover, in terms of technical regulations, the rules and practices for obtaining permits and licenses required can also be ambiguous. In addition they are rarely tailored to the specific situation of small-scale projects where a fast deployment timeframe is often at odds with lengthy and cumbersome permitting processes. .

Fifth, investor concerns about predictability and long-term viability of their projects in a given market can undermine viable investor interest. National plans for grid extension are not always clear, leaving mini-grid developers with a potential significant risk of competition from the grid at some point in the future. Furthermore, rather than complementing the national grid, mini-grids are often seen to be compete with it.

These financial, economic and regulatory challenges are critical constraints to the growth of the market for small-scale solar as a viable option when developing and operating decentralized power solutions in developing country contexts. In this light, how can international development agencies and climate financing bodies contribute to removing these barriers and scaling up investments in decentralized renewable energy solutions, and small-scale solar solutions in particular?

We believe that the development of this market should be based on three concurrent strategies that target the need to achieve market acceptance, structure a supportive ecosystem and mitigate some of the macro-economic risks.

Solutions

- In the short term, the focus should remain on activating the market through building acceptance of technologies and business models. Donors and subsidized climate financing providers should aim to “seed” multiple GMG developers in as many new markets as possible in order to accelerate commercial demonstration and the eventual transition to unsubsidized forms of capital. Innovative project-based seed funding could, for instance, be provided in the form of subordinate debt finance, which could be structured with relaxed collateral requirements and allow senior lenders to secure themselves with all of the movable collateral, such as solar equipment in the case of GMGs. Technical assistance should also be provided to boost the capacity of market entrants, specifically in the areas of business development, project development and general business administration.

- In terms of structuring a supportive ecosystem, donors should act on both the financing and policy/regulatory fronts. On the financing front, this should involve support aimed at facilitating the development of local financing sources, for instance through the provision of guarantees or assistance in structuring innovative financing vehicles that mitigate the risks associated with the low credit worthiness of customers. Donors should also lobby for a better alignment of relevant policies and regulations with the requirements of developing the market. This would include supporting tariff reform and improvement to permitting/licensing regulations adapted to the specific conditions of decentralized power solutions.

- Finally, thought should be given to systematically mitigating other macro-economic risks in order to allow investors to focus on their core business of building and developing GMGs jointly with local stakeholders. This would include supporting interventions to mitigate currency risks, such as providing exchange rate risk hedging.

Obviously these suggested interventions are diverse in nature and international donors and climate financiers each have their own instruments and know-how they can mobilize to intervene where their value added is the highest. The need is therefore for country specific well-coordinated interventions of multilateral institutions, development finance institutions, bilateral donors and climate finance institutions active in this sector. The potential for small-scale solar to play a significant role in the delivery of decentralized renewable energy is high, but so are the challenges. Only with a concerted approach that combines the specific capacities of these players will we be able to achieve scale and bring power to the millions which are still without it.

Cowater’s market-based approach to promoting access to decentralized power

Cowater is currently implementing two small-scale solar projects in rural communities that are piloting a combination of the approaches highlighted above.

In the Ajloun and Deir Alla regions of Jordan, which are critical poverty pockets in the country, Cowater is seeding the market for solar home systems and solar water heaters. The project, which is funded by the Government of Canada and the Jordan Renewable Energy and Energy Efficiency Fund (JREEF) is working on four fronts: (i) Activating the market through provision of subsidies and customer education on renewable energy and energy efficiency (ii) Structuring a financially viable system which will see subsidies phased out after some time with community based organizations aggregating demand, interfacing with local banks and managing the customers’ credit risk (iii) Training and building the capacity of energy service provider entrepreneurs to be able to satisfy the market demand (iv) Building the capacity of national organizations (regulator, power utilities, climate agency) involved in promoting the market for renewable energy and energy efficiency.

In Burkina Faso, Cowater is implementing a large-scale, four year renewable energy program. The program focuses on improving livelihoods through improved rural access to energy, with the following components: (i) rural electrification through grid extension and off-grid solar PV; (ii) training and support to local women’s groups in the use of renewable energy for selected agro-food processing value chains; (iii) pilot results-based payment program, training and support to social enterprises for the sale and distribution of pico-solar PV products; and (iv) capacity building and technical assistance at the local, regional and national government levels to strengthen the enabling environment for effective renewable energy promotion and development.

[1] Source: International Energy Agency, Energy Access Outlook 2017

[2] Source: https://www.engerati.com/article/mini-grids-power-africa%E2%80%99s-rural-electrification

[3] Source: SE4ALL, Energizing Finance – Scaling and Refining Finance in Countries with Large Energy Access Gap, 2017

Related Content

Tanzanian–Finnish collaboration supporting a ‘use it or lose it’ approach in Tanzanian Community Based Forest Management

The Governments of Tanzania and Finland have worked together in partnership for decades in the forestry sector in Tanzania. Since 2018, through the Forestry and Value Chains Development Programme (FORVAC), […]

The story of two interns: one year later and over 19,000 kilometers apart

Cover photo, from left to right, Cowater International former interns turned employees: Sofia, Samantha Julien (Sam), Aude, Elizabeth McGowan (Liz) and Astrid. Elizabeth McGowan (Liz) and Samantha Julien (Sam) both […]

Cowater International to participate in 11 EU External Action 2023 Framework Contract lots

Cowater International is delighted to announce that the European Union’s Directorate General for Intenational Partnerships recently signed the contracts related to the implementation of the Framework Contract Services for EU’s […]